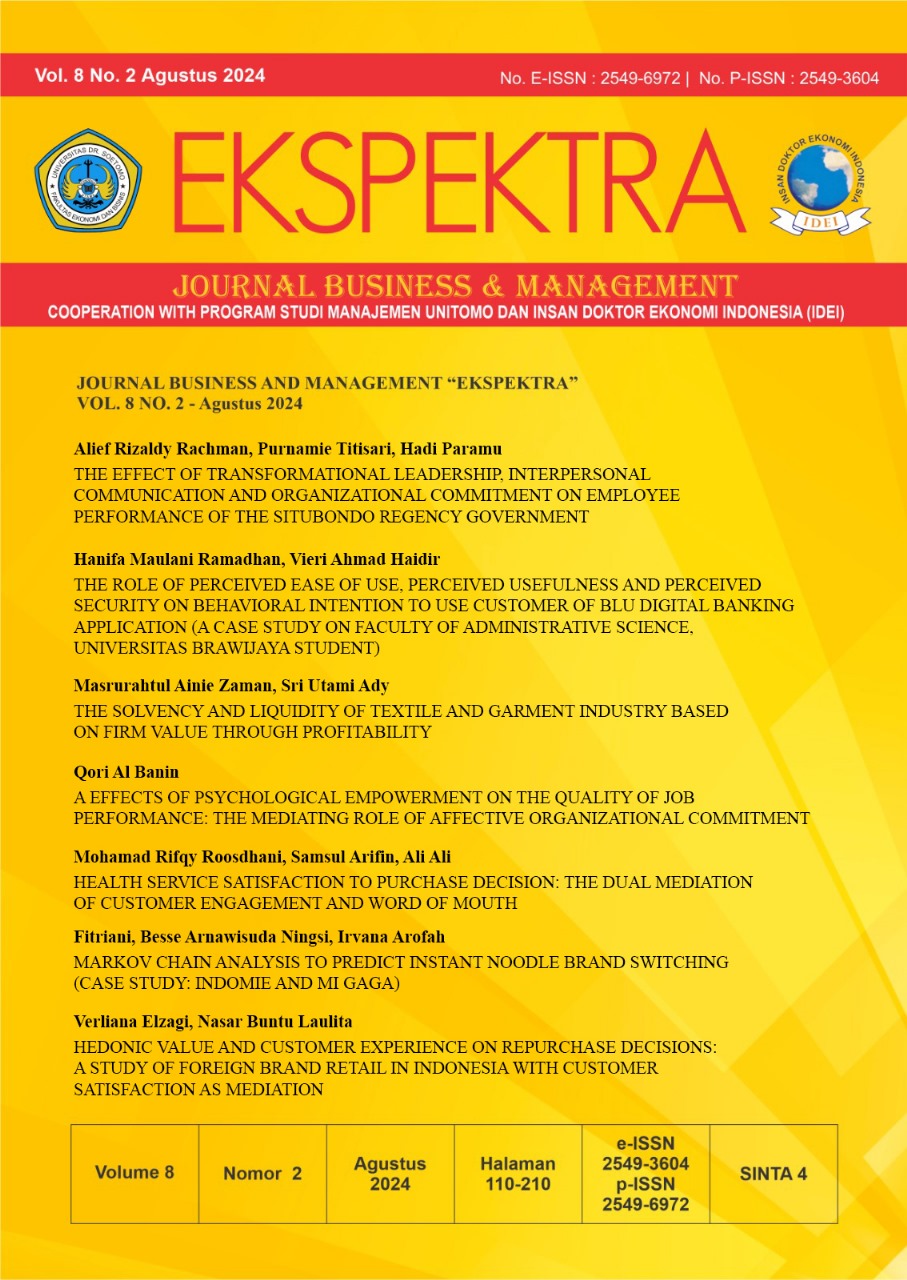

The Role of Perceived Ease of Use, Perceived Usefulness and Perceived Security on Behavioral Intention to Use Customer of Blu Digital Banking Application (A Case Study on Faculty of Administrative Science, Universitas Brawijaya Student)

Abstract views: 460

,

Abstract views: 460

,

PDF Journal downloads: 296

PDF Journal downloads: 296

Abstract

In the current period of the Industrial Revolution 4.0, the use of Information Technology has reached unprecedented proportions and is only expected to increase. The banking industry is only one of many that has seen growth thanks to Indonesia's steadily increasing rate of digitalization. Digital banking is a minor example of digitalization in the financial industry. PT Bank Digital BCA is one of many digital banks in Indonesia. Blu is the app used to conduct all of a digital bank's banking transactions online. Due to the novelty of the technology, more studies on the potential user base for digital banking are warranted (Behavioral Intention to Use). The goal of this research was to identify the factors that influence users' decisions about how often and for how long the Undergraduate Students on Faculty of Administrative Sciences, Brawijaya University will use the Blu digital banking app. SPSS version 25 is utilized to perform multiple linear regression for this study's analysis.The results of the data analysis that has been carried out show that: Perceived Ease of Use (PEOU), Perceived Usefulness (PU), and Perceived Security (PS) have a significant positive effect on the Behavioral Intention to Use (BIU) digital banking application Blu. The lack of three independent variables in explaining the dependent variable causes the need for additional variables for further research.

Copyright (c) 2024 Ekspektra : Jurnal Bisnis dan Manajemen

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Ekspektra : Jurnal Bisnis dan Manajemenis licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.