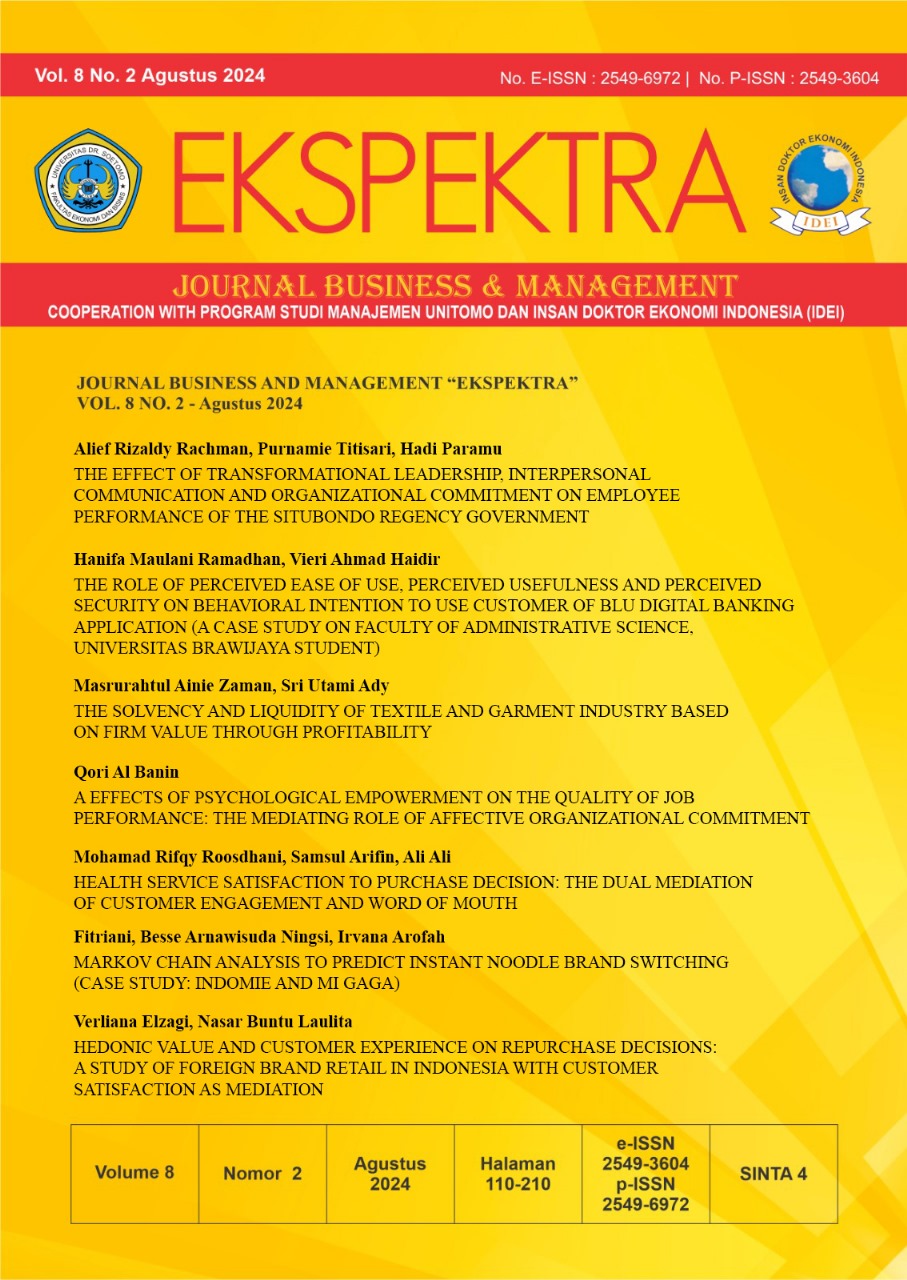

The Solvency And Liquidity Of Textile And Garment Industry Based On Firm Value Through Profitability

Abstract views: 226

,

Abstract views: 226

,

PDF JOURNAL downloads: 190

PDF JOURNAL downloads: 190

Abstract

The development of the textile and garment industry has led to the emergence of business opportunities for investors to invest. In making an investment, investors need to pay attention to the financial condition of the company that will invest by looking at the company's financial statements. The purpose of this study was to analyze whether solvency and liquidity affect firm value through profitability. The population used is manufacturing companies in the textile and garment industry sector listed on the Indonesia Stock Exchange for 2020 to 2022. This research uses SmartPLS to analyze. There are three stages of analysis in PLS, namely the model measurement stage, the structural model stage and the hypothesis testing stage. The results of this study indicate that the solvency and liquidity variables that affect profitability have an R2 value of 0.032 or 3.2%. 2While the solvency, liquidity and profitability variables that affect firm value have an R value of 0.307 or 30.7%. Solvency has an insignificant effect on profitability. Liquidity has a negative insignificant effect on profitability. Solvency has a positive insignificant effect on firm value. Liquidity has no significant positive effect on firm value. Profitability has a significant positive effect on firm value. Solvency and liquidity have an insignificant negative effect on firm value through profitability.

Copyright (c) 2024 Ekspektra : Jurnal Bisnis dan Manajemen

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Ekspektra : Jurnal Bisnis dan Manajemenis licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.